1.Market summary

The market demand of 2023H1 graphite electrode shows a weak situation of supply and demand, and the price of graphite electrode has no choice but to decline.

The graphite electrode market had a brief “spring” in the first quarter. In February, as the price of raw material petroleum coke continued to rise, the price center of graphite electrode moved up, but the good times did not last long. In late March, raw material prices did not continue to rise but fell, superimposed downstream demand performance was poor, graphite electrode prices loosened.

After entering the second quarter, with the further increase of loss and production restriction in short-process steel mills, the overall sales of the graphite electrode industry are not smooth, internal order competition begins, and resources are grabbed at low prices, and some small and medium-sized graphite electrode manufacturers are facing serious losses and facing conversion, suspension or elimination.

2.Supply and demand analysis

(1)Supply side

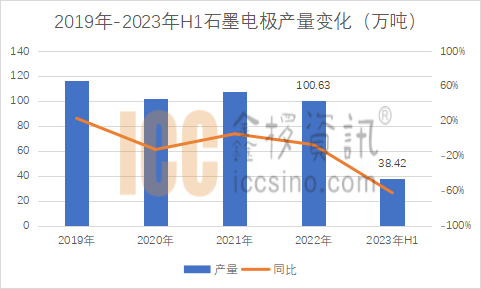

According to Xinhuo statistics, the operating rate of H1 China’s graphite electrode industry remained low in 2023, and the total output of graphite electrodes in China in the first half of the year was 384200 tons, down 25.99 percent from the same period last year.

Among them, the output of graphite electrode head manufacturers mostly decreased by about 10% compared with the same period last year, the output of the second and third echelon manufacturers decreased by 15% and 35%, and even the output of some small and medium-sized graphite electrode manufacturers decreased by as much as 70-90%.

The output of graphite electrodes in China first increased and then decreased in the first half of 2023. Since the second quarter, with the increase of shutdown and overhaul in steel mills, the production of graphite electrodes is negative, basically controlling production and reducing production or balancing profits through the production of other graphite products. The supply of graphite electrodes decreased significantly.

In 2023, the output of H1 China’s graphite electrode industry reached 68.23%, maintaining a high degree of concentration. Although the output of China’s graphite electrode industry has declined significantly, the industry concentration is constantly increasing.

(2)Demand side

In the first half of 2023, the overall demand of graphite electrode market is weak.

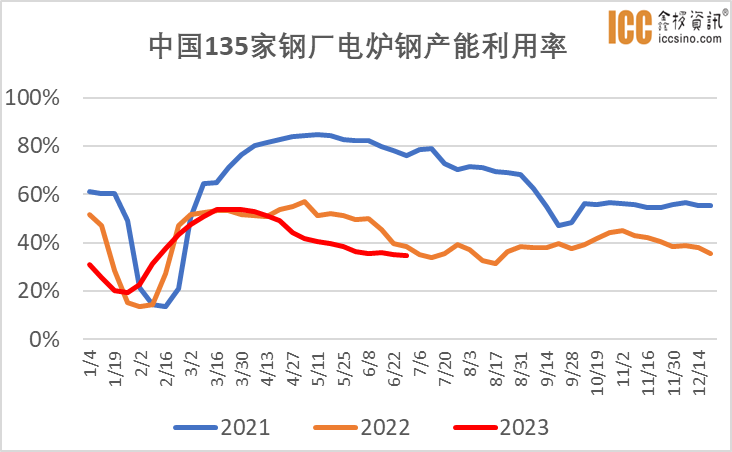

In terms of steel use, the poor performance of the steel market and the accumulation of finished material inventory have led to a reduction in the willingness of steel mills to start work. In the second quarter, electric furnace steel mills in the south-central, southwest and North China regions could not bear the pressure of upside down costs and chose to stop production and limit production, resulting in a reduction in demand for graphite electrodes again, demand continued long process rigid demand mainly sporadic replenishment, limited market turnover, and poor procurement performance for graphite electrodes.

Non-steel, metal silicon, yellow phosphorus market performance in the first half of the weak, some small and medium-sized silicon factories with sharp decline in profits, the pace of production has also slowed down, the overall demand for ordinary power graphite electrodes is general.

3.Price analysis

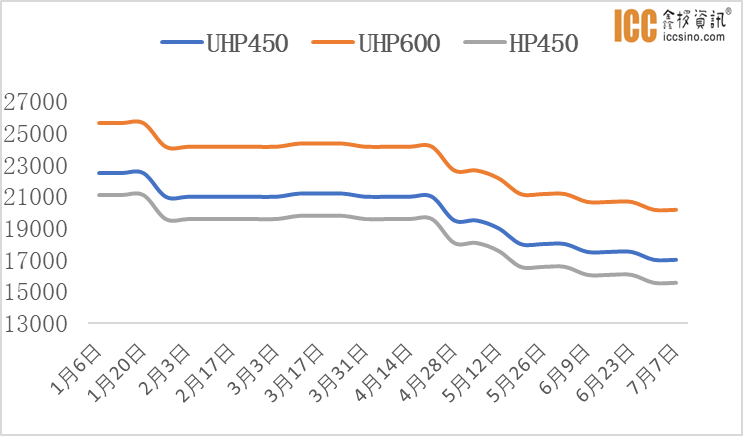

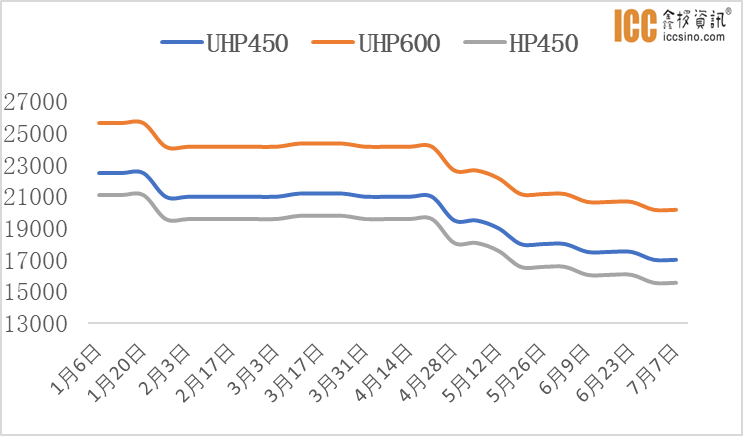

The market price of graphite electrode declined obviously in the first half of 2023, and every drop was caused by the decline of market demand.

From the point of view of the first quarter, after the Spring Festival holiday in January, some graphite electrode manufacturers stopped work for a holiday, and the intention to start work was not high. In February, as the price of raw material petroleum coke continued to rise, graphite electrode manufacturers were more willing to raise the price, but as the price of raw materials turned lower, the performance of demand downstream was poor, and the price of graphite electrode loosened.

After entering the second quarter, the prices of upstream raw materials low-sulfur petroleum coke, coal tar pitch and needle coke all began to fall, the loss range of electric furnace steel mills superimposed downstream increased, the demand for graphite electrodes was less again under the suspension of production and reduction of production, and graphite electrode manufacturers were forced to seize the market at low prices, making the price of graphite electrodes decline significantly.

2023H1 China Graphite electrode Price trend (Yuan / ton)

4.Import and export analysis

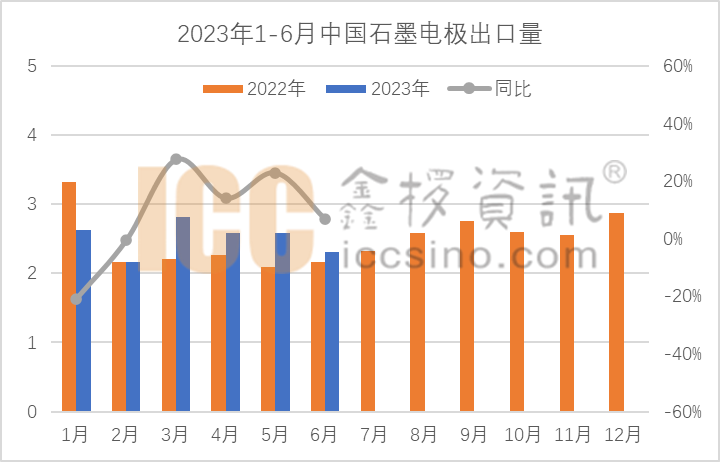

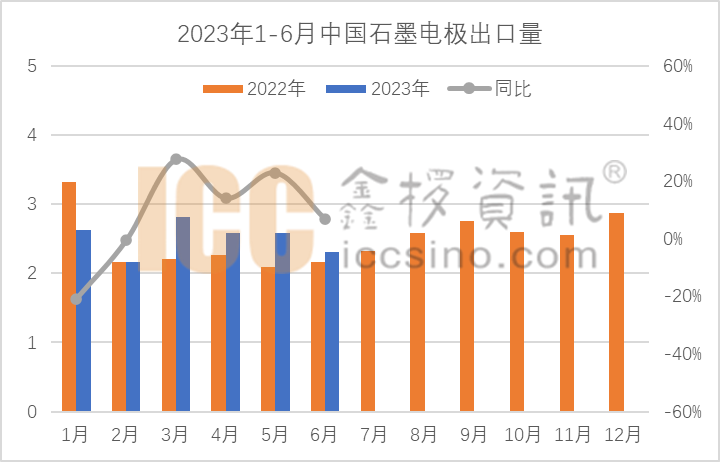

From January to June 2023, China exported a total of 150800 tons of graphite electrodes, an increase of 6.03% compared with the same period in 2022. South Korea, Russia and Malaysia ranked among the top three countries in China’s graphite electrode exports in the first half of the year. Under the influence of the Russian-Ukrainian war and EU anti-dumping, the proportion of 2023H1 Chinese graphite electrode exports to Russia increased, while that to EU countries decreased.

5.Future forecast

Recently, the Politburo meeting set the tone for economic work in the second half of the year and sought to advance steadily. The policy will continue to tap the throttle on the consumption and investment side, and the real estate policy will probably continue to be optimized. Under this stimulus, the market’s expectations for the domestic economic situation in the second half of the year have also turned optimistic. Demand in the steel industry will recover to a certain extent, but it will take time for terminal demand to be boosted and transferred to the graphite electrode market. However, driven by the rise in raw materials in August, It is expected that the price of graphite electrode will usher in an inflection point, and it is expected that the domestic price of graphite electrode will rise steadily in the second half of the year.

Post time: Aug-02-2023